My biggest pet peeve about traditional personal finance advice is that it rests on the assumption that retirement always happens at 65. If you don’t take a moment to question this, then your retirement plan will likely be built around this assumption.

Instead, consider that retirement is not an age, it is a condition. In order to never work again, your assets (stocks, bonds, real estate, passive income streams) must generate enough money so that you no longer have to work to earn a paycheck. Once you realize this, you suddenly have the freedom to dictate how fast you reach this condition.

Traditional Advice

Take a second to google “how much should I save for retirement?” For me the first thing that pops up is this:

When saving for retirement, most experts recommend an annual retirement savings goal of 10% to 15% of your pre-tax income. High earners generally want to hit the top of that range; low earners can typically hover closer to the bottom since Social Security may replace more of their income.

Source: NerdWallet

Why is there a ceiling on this range? If you are making enough money to save 30% why do financial “experts” not advise you to save more?

This is because all traditional financial advice uses the assumption that you will retire at 65. However, what if I told you that you could retire earlier than that?

New Way to Think About Retirement

There are two things you can do to accelerate retirement:

- Increase your savings rate

- Lower your expenses

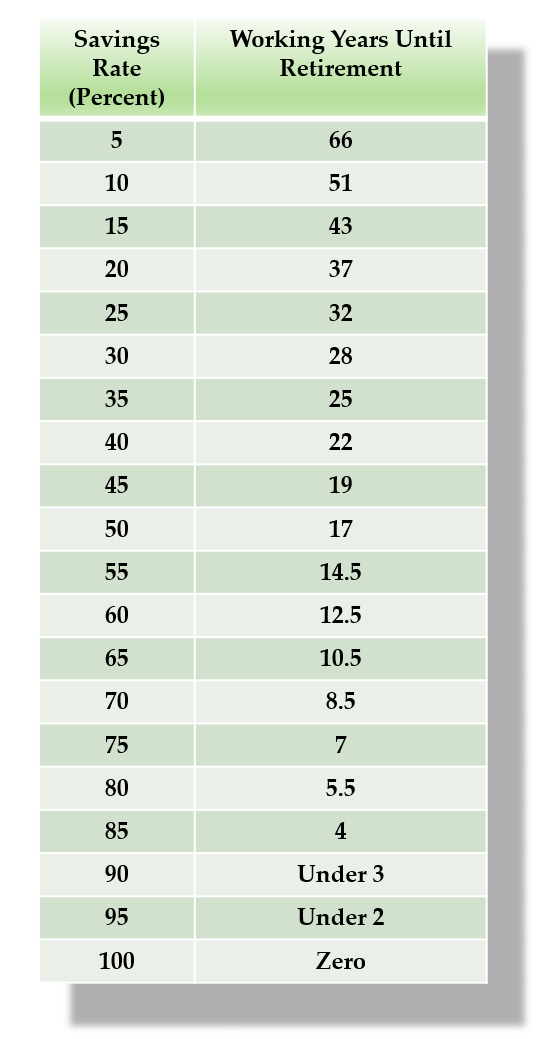

This is one of the most iconic pictures in the financial independence community. Mr. Money Mustache boiled down this idea into one simple chart that shows you at what age you can retire based on how much of your income you save/invest instead of spend.

Retirement is not an age, it is a condition. Once your assets (stocks, bonds, real estate, passive income streams) generate enough money to cover your expenses without you trading your time for money (work), then you can retire. When you turn 65, this doesn’t magically happen on its own. You can determine how fast or slow this process goes based on your income level, lifestyle, and financial decisions.

I’m not saying that everyone has the capacity or privilege to be able to save 75% of their income and retire in seven years. I’m only saying that if you do have extra room in your budget, consider increasing your savings rate by 5%, 10%, or more. It could shave 6+ years off your working life and help you reach financial freedom that much faster.

Follow me @twocentswithjulia on Instagram for your daily money inspiration and to follow my journey to financial independence.