This year marks a huge milestone in my financial independence journey: I’ve reached CoastFI (Coast Financial Independence) which means that if I never invest another penny, I can retire at 65 and keep my expenses the same as they are now.

Note: My CoastFI number is based on my expenses now rather than what they will be in retirement. I present the calculation in the rest of this article using expenses in retirement which is a better measure. For example, my expenses are likely to go up with increased healthcare costs. I will also likely have maintenance for a house that I will probably own. For these reasons, my CoastFI milestone is more of a token milestone meant for my own celebration than one that has real implications in my retirement planning. In short, I plan to continue aggressively investing my money to increase my retirement savings.

How to Calculate Your CoastFI Number

CoastFI simply means that the money you have invested for retirement now are expected to grow enough to cover the expenses you expect to have in retirement.

In order to calculate your CoastFI number, you need a few things

- Estimate of your annual expenses in retirement (EXP)

- Number of years until retirement (NYEAR)

- Assumption of average inflation-adjusted growth rate of investments between now and retirement (GRO)

- Assumption of the safe withdrawal rate in retirement. This is the amount of money you can siphon off your investments each year in retirement so that the growth replaces what was withdrawn. 4% is the research-backed rule of thumb. (WD)

Note: #3 will depend on what you are investing in and how conservative you want to be. The inflation-adjusted return of the S&P 500 since 1957 was 6.31% (as of 2022). This could be a good estimate if you are primarily investing in index funds that track the S&P 500. Use a lower number if you have a more conservative asset mix (i.e. bonds) or if you want to see what would happen if inflation out-paced historical levels or the market grew at a slower pace than historically.

Using an inflation-adjusted return will allow us to calculate how much we need to invest in order to withdraw an amount of money that feels like the amount of money we specified in EXP using today’s dollars. In retirement, we will actually need to withdraw a nominal amount that is much more than EXP since things will naturally cost more, but this calculation accounts for that.

Formula

CoastFI = (EXP/WD)/(1+GRO)^NYEAR

Example CoastFI Calculation

Let’s use an average 25 year old as an example of how this calculation works.

- EXP: According to the Bureau of Labor Statistics, the average amount someone in retirement (65-74 years old) is $4,703 per month or $56,436 per year.

- NYEAR: The average 25 year old will have a retirement age of 65, so they have 40 years until retirement.

- GRO: We will use 6.31% which is the average inflation-adjusted return of the S&P 500 since 1957.

- WD: We will use 4% which is the research-backed rule of thumb.

CoastFI = ($56,436/0.04)/(1+0.0631)^40

CoastFI = $122,048

This means that the average 25 year old would need to have $122,048 invested in order to coast to retirement.

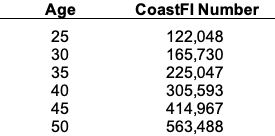

CoastFI at Different Ages

Let’s see how the example above changes with the average American at different ages. Here, I have toggled the NYEAR argument to correspond with a 30, 35, 40, 45, and 50 year-old.

As you can see, as you get older, you need much more money to be able to reach CoastFI. This is the power of compound interest. The earlier you start, the more your money will grow.

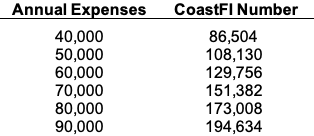

CoastFI at Different Expense Levels

Another way we can toggle this is seeing how much the average 25-year-old would need depending on how much they plan to spend in retirement.

Increasing your expected amount of expenses in retirement drastically changes how much you need to have invested in order to reach CoastFI. It is important to understand the risk factor that increased expenses poses to your retirement. For example, if you end up needing expensive drugs, treatment or care, your CoastFI amount might not cover what you will actually need in retirement.

How to Use CoastFI in your Financial Planning

As we have seen, aiming for CoastFI is a way to front load your retirement planning early in life which means that the total amount invested would be lower than if you focused on it later in life. Once you reach CoastFI, you may be able to experience more time freedom by doing work you enjoy, but pays less, or taking breaks to travel or focus on family.

The risks of CoastFI are that assumptions used in the calculation really affect the amount of money you would need in retirement. For example, your expenses might end up being higher than expected due to healthcare costs, higher cost-of-living, etc. Inflation and market growth may not follow historical patterns which would affect how fast your money grows between now and retirement and also how much you can safely withdraw in retirement.

I personally use CoastFI as a fun milestone to celebrate and take pride in, but I currently am not using it as a serious implication in how I plan for retirement. At 25, I have many prime earning years ahead of me that I intend to use to aggressively increase my investments and plan for the unexpected. CoastFI does, however, give me peace of mind that because I started so early, my money will be working the hardest it can which will give me options later in life.