So, you just graduated and you’re wondering what to do with that pile of debt you just got handed. The amount seems insurmountable and you feel like you’ll never reach the day that it will be paid off. You’re in good company. About 70% of students graduate with student loan debt with an average balance of $30,000[1]. With a typical term of 10 years, this challenge is immense.

There are plenty of sources on the internet that can give you an overview of how to approach paying off student loan debt.

If you’re content paying the minimum each month and think that would fit in with your lifestyle the best or even if you’re struggling to scrape together the minimum, I recommend this article. It offers basic strategies for managing student loan payments and even some ways to decrease your payments!

I recommend this one for people who want to get rid of their debt quickly, have wiggle room in their budget, and think they can pay over the minimum payment each month. Dave Ramsey is a financial genius in general and I recommend his articles for any personal finance topic really!

There are arguments for and against accelerating the process of paying off student loans which you can read about in both articles. If you’re hoping to start accelerating the process, Ramsey mentions in his article that making financial sacrifices is one way to make big moves in paying down your student loan debt. Today, I’m going to demonstrate through some simple calculations just how big of an effect four different lifestyle changes can make on the lifetime of your loan. Although the exact numbers I show will vary for each individual situation, the idea is the same for everyone. Bigger sacrifices can lead to better financial gains, however small sacrifices can also make a tangible difference.

Lifestyle Changes to Crush Student Loan Debt:

1. Live at home/with parents for 9 months

2. Get a roommate for 12 months

3. Fun money goes to loans for 6 months (call it Covid cash)

4. Pack lunch 4 days a week for 12 months

As you can see there are some drastic changes, but also some pretty doable ones. With just 12 months of implementing these changes the average student loan holder can cut up to 3 years off of the loan term and save up to $4,500 in interest payments. That’s a lot of money. Read on to see just how much of an impact each method can have on your loan term and interest payments as well as what assumptions I based each calculation on.

Base Case Assumptions

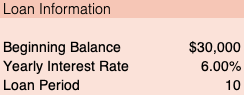

The case study that I will be working with is the average student loan profile in America today that I mentioned above. I’m assuming a total student loan balance of $30,000 at 6% interest (probably higher than average, but I wanted to be conservative). I assumed a 10 year term which is a typical term length for this size of loan. I assume that the debt is all part of one loan when in reality, the debt could be in the form of multiple loans with various starting balances and interest rates. For the purpose of this article, treating it as one loan does not change the general outcomes.

Under these assumptions, this student would contribute monthly payments of $333 and end up paying a whopping $10,000 in interest over the 10 years of the loan term.

The scenarios I’ve created below will show how increasing monthly payments by various amounts in the next year can decrease the term of the loan and the total interest paid.

Live at Home or with your Parents for 9 months

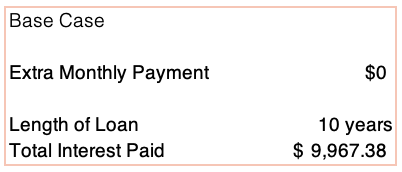

If you are in the situation where living at home is an option, this could be a great way to significantly cut down on your living expenses and put that money towards loan payments. If your new job is close to home and you intended to get your own place, consider delaying that move for a couple months and make that childhood bedroom your temporary residence.

For this calculation, I assumed the average rent right out of college is around $800/person. Keep in mind this includes anywhere from New York City ($$$) to Cleveland ($). You may have to adjust this number up or down depending on where you live.

By funneling $800/month for nine months into student loan payments instead of rent, the average loan holder could cut off a whopping 3 years off the loan and save $4,500 in interest payments throughout the life of the loan. That’s some serious moola.

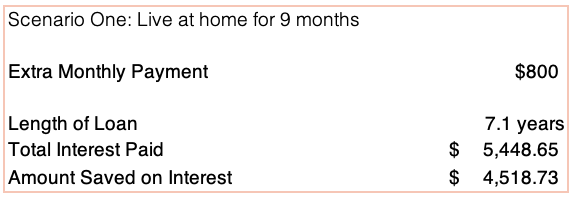

Get a Roommate for 12 Months

I know that graduating college signals independence and freedom and for many that includes finally being able to have a place to call your own. However, just one more year of sharing a space can put some big bucks back into your wallet. It also may make the transition into adulthood easier especially if your roommate becomes your friend! According to this site, having a roommate saves you an average of $500/month in the U.S. This is pure savings in rent. There are also additional savings in utilities, internet, cable, and subscriptions that you may want to take into account.

By putting $500/month towards student loan payment each month for a year, this case could shave 2.5 years off the student loan term and save a handy $3,800 in interest over the lifetime of the loan.

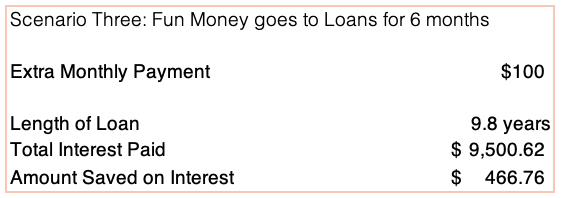

Fun Money Goes to Loans for Six Months

If you are reading this article in the Spring of 2020, this will mostly apply to you. As Covid-19 continues to cramp our style and prevent us from all the things that were fun, but also expensive, consider redirecting those funds to your student loan debt. Of course, this crisis has put a lot of people in precarious financial situations, so this may not be feasible if your dip in expenditures has been accompanied by a dip in income.

I valued an average month of going out, getting drinks, Ubers, movies, etc. at $100/month or $25/week. I think this is pretty reasonable given my lifestyle and many others that I know, however you may have to adjust the estimate up or down given your lifestyle.

Putting these funds towards loan payments could take 0.2 years off the term of the loan and save $466 in interest payments. Although this is just a modest benefit, it is a virtually painless lifestyle change since we’ve all been forced into it already!

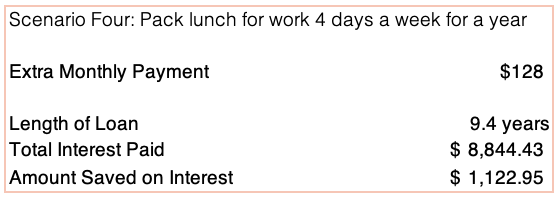

Pack Lunch 4 Days a Week for a Year

This is perhaps my favorite scenario because it’s a super simple lifestyle switch, also promotes healthy eating, and is something that I think everyone should be doing anyway! Additionally, if you start out doing this from day one on the job, it will quickly become a habit and you won’t know the difference.

An average lunch out costs around $8. Packing lunch for four days would save around $32/week which comes out to $128/month. I left one day for eating lunch out because we all deserve to treat ourselves sometimes!

This small change would take off 0.6 years off of the student loan and save $1,100 in interest payments! That’s a huge win for something so easy.

The Progress Doesn’t Have to Stop After One Year

Whether you’re ready to make big sacrifices to get rid of that student loan debt in no time, or you just want to implement simple smart strategies to modestly accelerate it, there’s a plethora of opportunities to tweak your lifestyle and start tackling that debt.

All these estimates focused on only the first year of payments. Think about how much of a difference even longer-term strategies could make! If you get into the habit of deliberately allocating money to extra loan payments now, it’ll be a no brainer in the coming years and your student loan payments will seem much more manageable!

What Lifestyle Change Do You Want to Make?

Have an idea for another lifestyle change that you’d be interested in seeing the results of? Leave a comment down below and I’ll do a follow up article or Instagram post with the outcomes of your submissions!

Disclaimer: These outcomes are based on assumptions and are for informational purposes only. Please do not construe any such information as financial advice. This content is of a general nature and does not address the circumstances of any particular person or entity.

[1] Data from https://www.savingforcollege.com/article/student-loan-statistics