Yay! It’s payday and your direct deposit just hit your bank account. What’s next?

Most people wing it when it comes to deciding where to send their money whether that be towards bills, variable expenses like shopping or eating out, or even saving. In fact, according to Bankrate.com, 38% of Americans don’t save more money because of expenses.

When you aren’t sure where your money is going, it’s easy to be left with close to $0 in your account at the end of the month.

This is why it is really important to structure how and when you allocate each paycheck. By flipping the conventional “save what’s leftover each month” mentality, you will find that “paying yourself first”, or putting money into savings right when you get paid, will allow you to save much more than you would have with the former mindset.

What is a money flow?

I’m coining the term money flow (love those puns) to refer to anytime that you move money from one place to another. There are two types of flows

Inflow– money coming into your account

Outflow– money leaving your account

While I may have omitted some types of flows in my graphics below, I made sure to include the most basic ones such as direct deposit, bills, and savings.

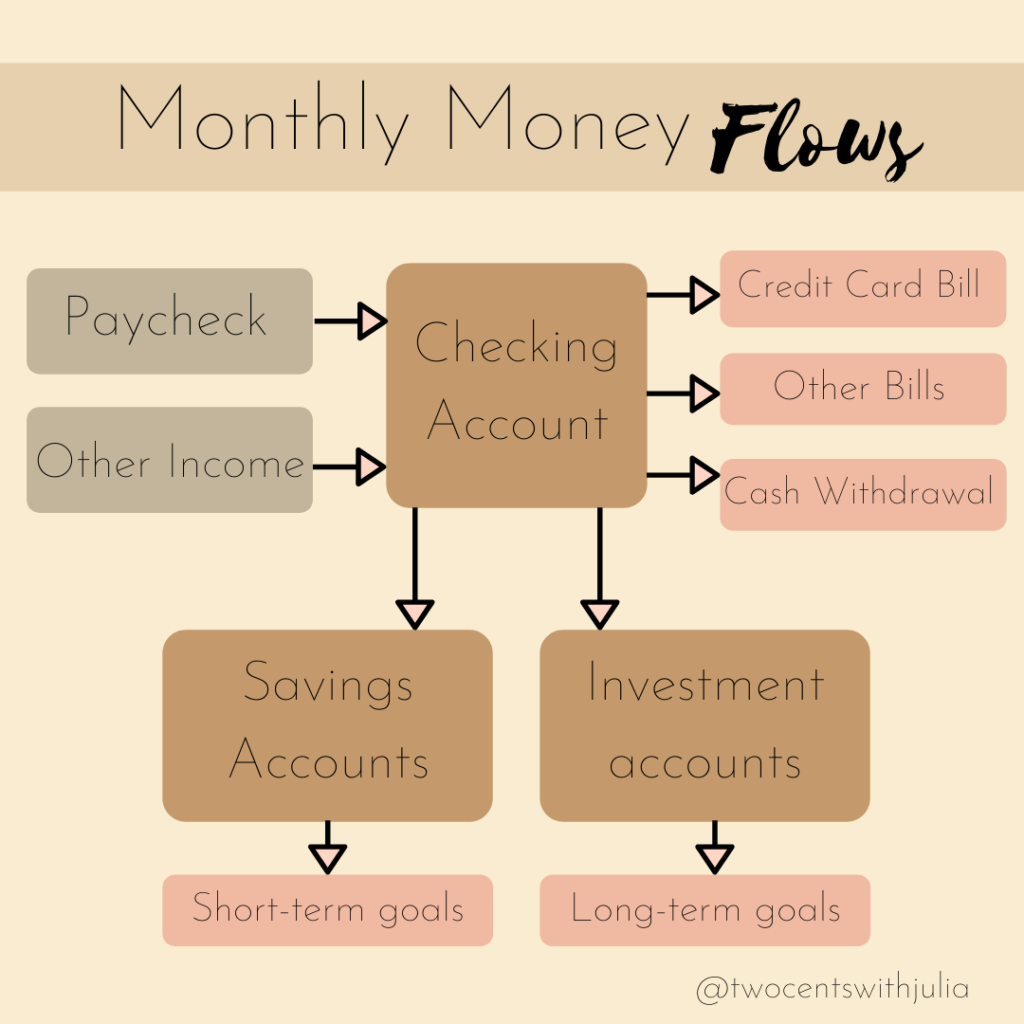

Monthly Money Flow Overview

Here, we see that the brown boxes represent different types of accounts, the gray boxes are inflows and the pink boxes are outflows. You will notice that some outflows require the money to pass through two accounts before being realized.

Ex: Income -> Checking Account -> Savings Account -> Short-term Goals

This is because checking accounts are a lousy vehicle to hold your money in since it earns very low interest. The goal of structuring your money flows like this is to redirect your money to better accounts after accounting for expenses and reach a checking balance of near $0 at the end of each month.

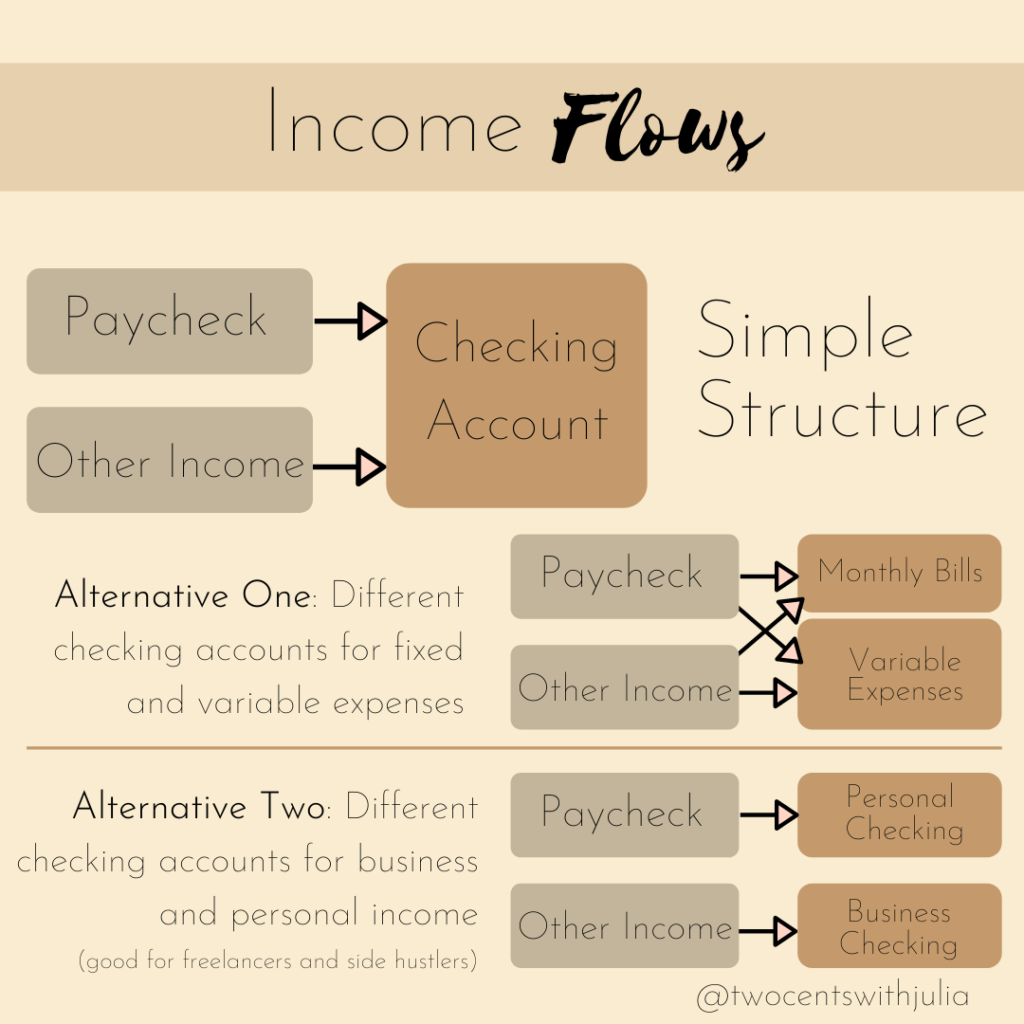

Step 1: Structure Your Checking Accounts

Most of you have probably set up a direct deposit before and may just dump it all in one account. Did you know you can actually separate your direct deposit over multiple accounts?

This a useful feature if you would like to organize your checking accounts by purpose. For example, you could dedicate one checking account to recurring bills and one to variable expenses like eating out or entertainment.

Another reason you would want to have multiple checking accounts is if you earn any business or freelance income that needs to be taxed later on.

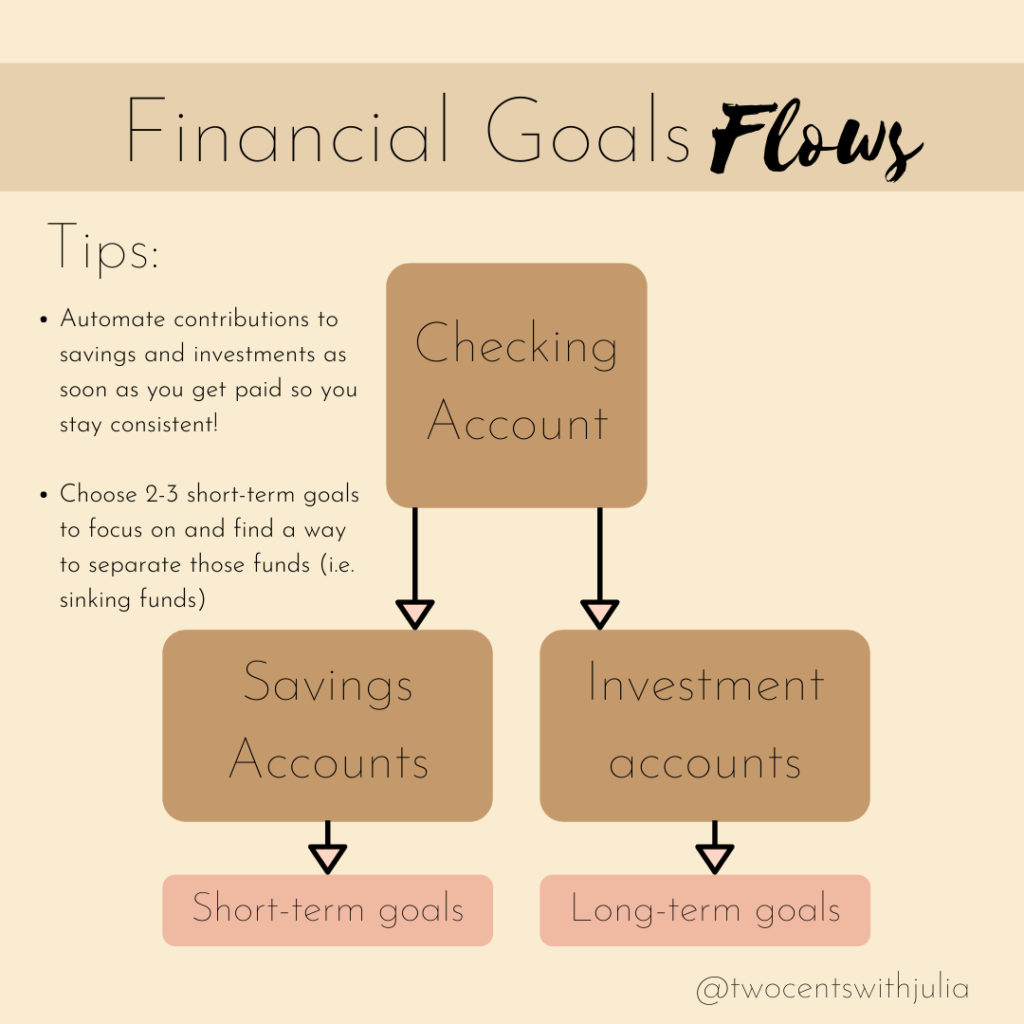

Step 2: Pay Yourself First

Once that direct deposit hits your checking account, it’s time to dedicate some money to savings and investments! Whether you’re building an emergency fund, contributing to your Roth IRA, or saving for that beach vacation, make sure to set up automatic transfers to whichever accounts you are holding those funds in.

By automatically transferring the money right after the direct deposit hits, you are taking away any temptation to spend that money on other things instead. You are also making a promise to yourself to fulfill all your financial goals! We love a financially responsible twenty something!

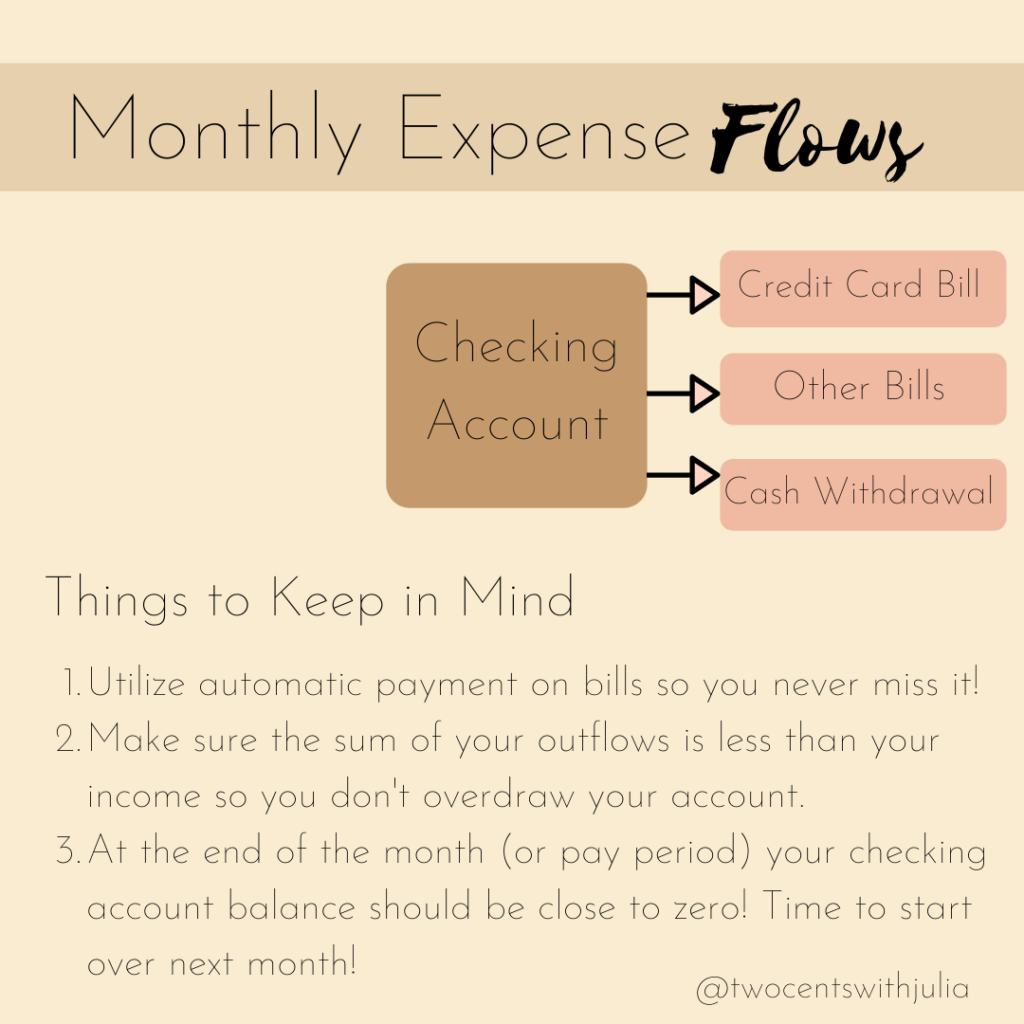

Step 3: Pay for your Expenses

If you’ve budgeted correctly, the money left over in your account should be just enough to cover your monthly expenses. If your new to structuring your money in this way, be sure to give yourself a cushion so you don’t overdraw your account.

If you really want to level up your money organization skills, you can set your bills to automatic payments. This is especially important for your credit card bill so that you never accidentally miss a payment.

At the end of the month, you should be close to $0 and it’s time to start over again!

Want More Two Cents with Julia?

I would love to connect with you in the comments or over on Instagram!

Head to @twocentswithjulia to send me a message!