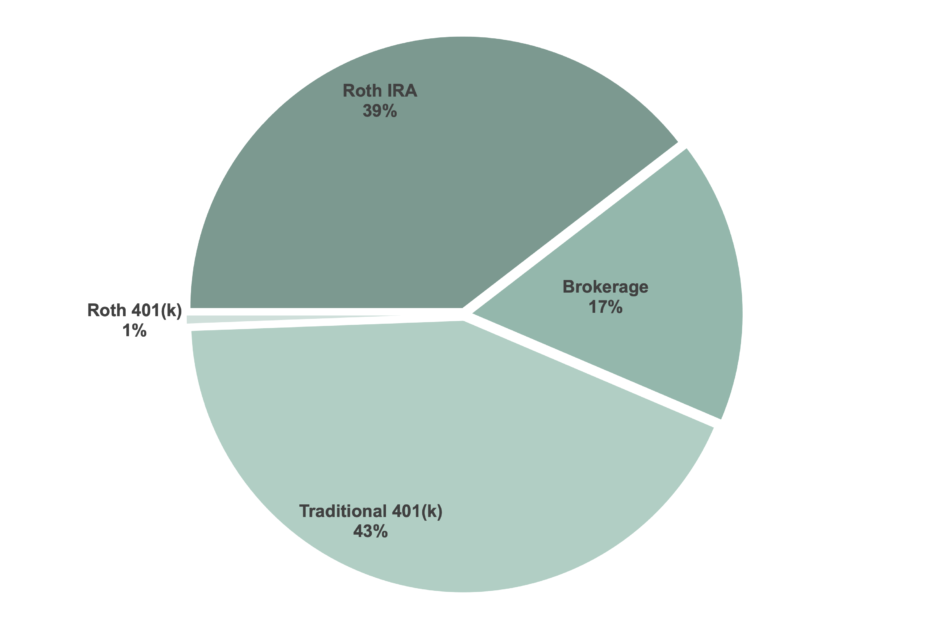

Today I’m giving you a peek 👀 at my investing breakdown! A lot of you ask me where to invest and I get it, all the account options can be confusing.

Here’s a breakdown of where I put my money and why!

Traditional 401(k):

This is the first destination for my money because you knowww I’m taking advantage of my employer match! My match is 3% of my salary, so that is the minimum amount I put here. I like the fact that my traditional 401(k) is tax deferred. That means I pay no taxes now! So I contribute more than my match with the aim to max it out this year!

Roth IRA:

This was my first investing account and most loved! Roth IRA’s are a lot more flexible than 401(k)’s. They have exceptions for times that you can pull out the money before retirement! I hold my Roth IRA with Fidelity where I use their no fee funds, so all my returns go to me and me only!

Brokerage Account:

I just opened my brokerage about 2 months ago and I’m loving it so far! This is where my money goes when I know I’m on track to reach my tax advantage account goals. Since the money is taxed going in and coming out, it’s not my priority account, but it’s a great place for me to put money that doesn’t have any better place to work!

Roth 401(k):

I just started contributing this month! It’s a baby account right now, but I’m planning to grow it next year! Splitting my contributions between my Roth and traditional 401(k) is more of an art than a science, but I’m trying to find the balance that feels right!

Where do you invest your money? Do have a different tax or investing strategy? Share your thoughts in the comments below. Also, don’t forget to follow me @twocentswithjulia on Instagram for daily money thoughts from a 23-year-old on a wealth building journey!

Pingback: How to Live in Chicago on a Budget in your 20s – Two Cents with Julia